Islamic finance has an important role to play as it becomes of increasing interest to global responsible finance.

Exploring the shared principals in emerging markets, the RFI Foundation has organised the Responsible Finance Summit; co-organised by Middle East Global Advisors and Bank Negara Malaysia. Taking place on 30-31 March, 2016 in Kuala Lumpur, Malaysia, the Summit aims to forge meaningful alliances between Islamic finance (IF) and the responsible finance ecosystems, while harnessing the emerging market growth of Islamic finance and the synergies that exist between Islamic finance and global responsible finance.

Both ecosystems share many common challenges and similar traits. A $2 trillion industry, Islamic finance has a strong footprint in emerging markets and appears to have reached a turning point in its global recognition, presenting an ideal opportunity to boost its appeal beyond its usual consumers. In parallel, practitioners in responsible finance are trying to shed the industry’s reputation as a “niche” one and face a credibility issue with conventional finance in developed markets.

Even as Islamic finance has been able to demonstrate an ability to profitably implement a values-based approach, it aspires to develop a more positive and impact-driven approach, given its existing harmonised exclusionary screening approach. This should enable the industry to create a robust value proposition that incorporates universal values-based impact, good governance and environmental sustainability.

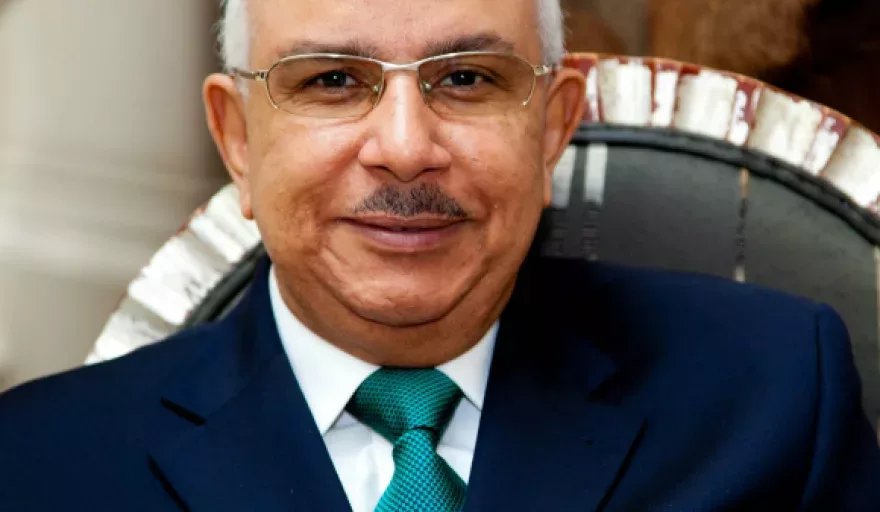

Moving towards these common principles can benefit from approaches used in developed markets by responsible investment institutions. RFI Foundation Chairperson of its Board of Trustees, Professor Datuk Rifaat Abdel Karim, noted: “By promoting the shared principles that underlie the motivations for responsible finance, Islamic finance can play an instrumental role in expanding it, particularly in the emerging markets where Islamic finance has developed its deepest roots.”

Abdel Karim continued: “Malaysia represents a particularly instructive case where regulatory bodies have supported convergence between Islamic finance and traditional responsible finance towards equitable, inclusive and sustainable economic development.”

The Summit will focus on identifying ways that the industry, regulators, and other stakeholders can increase the footprint of responsible finance in emerging markets and make Islamic finance better integrated within the global responsible finance industry.

The Securities Commission’s (SC) new Sukūk regulatory framework paved the way for the world first issuance of a SRI Sukūk by Khazanah Nasional, the sovereign investment arm of the Malaysian government, to fund educational investments with a structure that lowers finance cost if certain impact metrics are achieved.

“Developing both global and domestic responsible finance markets that help investors integrate environmental, social and governance factors are crucial for expanding responsible finance in emerging markets,” said Blake Goud, the CEO of RFI Foundation.

He continued: “I believe that Islamic finance has an important role – through capital markets, banking, insurance – in supporting inclusive economic development and Malaysia’s efforts demonstrate how to make responsible finance industry more inclusive and globally integrated.”

The Responsible Finance Summit will take place at Sasana Kijang, a renowned centre for knowledge and learning excellence established by Bank Negara Malaysia.

For more information on the Summit, please visit rf-summit.com.